-

Business Risk

Grant Thornton Gibraltar’s Business Risk Services team brings together a group of specialists with an unrivalled depth of industry experience. Our solutions support clients in growing and protecting the inherent value of their businesses with practical risk management systems.

-

Consulting

Our solutions focused team guarantees quick turnarounds, and with lower partner to staff ratio than most we can provide bespoke offerings tailored to your unique needs.

-

Deal Advisory

Our experienced Deal Advisory team has provided a range of transaction, valuation, deal advisory and restructuring services to clients for the past two decades.

-

Financial Accounting and Advisory Services (FAAS)

Our team of experts here at Grant Thornton is committed to providing best-in-class solutions to help our clients effectively overcome the hurdles associated with complex regulatory compliance requirements, especially when entering new markets.

-

Fintech

Grant Thornton’s cross-functional, dynamic team of specialists can help with your FinTech needs. Whether in supporting existing market participants looking to innovate in products and services, or new entrants seeking to upscale their FinTech businesses within the complex financial services environment, we have the solution for you.

-

Forensic Accounting

Organisations may undergo some type of dispute or internal investigation during their lifetime. Our Forensic and Investigation Services team can seek evidence that can make the difference between finding the truth or being left in the dark.

-

Insolvency

At Grant Thornton we offer solutions for all insolvency matters. We have a team of experts who deliver innovative and practical solutions and who have assisted a range of organisations and individuals return to prosperity.

-

Restructuring

Grant Thornton is a leading provider of insolvency and corporate recovery solutions.

-

Risk Advisory

Our Risk Advisory team delivers innovative solutions and strategic insights for the Financial Services sector, addressing disruptive forces, regulatory changes, and emerging trends to enhance risk management and foster competitive advantage.

-

Sustainability Advisory

Our Sustainability Advisory team works with clients to accelerate their sustainability journey through innovative and pragmatic solutions.

-

Accountancy Services

The Accountancy function is critical to any modern business. Our team of qualified accounting professionals at Grant Thornton Gibraltar can draw on their depth of experience and knowledge to ensure your accounts are expertly prepared to meet with all local and international standards.

-

Audit & Assurance

Grant Thornton is bringing a fresh approach to the audit process in Gibraltar by combining leading-edge technologies with a highly qualified team of audit professionals, all of whom are experts in key sectors of Gibraltar’s economy, and particularly in dealing with regulated entities.

-

Company Tax

Our highly qualified and experienced team of tax professionals works closely with our clients to gain a deep understanding of their specific needs in order to ensure they are compliant in every aspect of their corporation tax requirements.

-

Employment and Payroll Services

Here at Grant Thornton, we can minimise the hassles associated with the HR function for companies in Gibraltar. By taking care of all your company’s Employment, Payroll and associated requirements to the highest standards, you can focus on what you do best with the peace of mind that your local compliance needs are being taken care of by professionals.

-

Global mobility Services

Our team of experts here at Grant Thornton provides a full range of professional services and advice to employers. Whether you require assistance in performing employment tax compliance reviews, or your business demands bespoke global mobility strategies tailored to your specific needs, we work closely with employers at every stage of the staff lifecycle thereby ensuring that all decisions are made giving consideration to both compliance and tax efficiency.

-

International Tax

In a world where disaggregating a company’s tax and operational presences is increasingly challenging, Grant Thornton’s approach to managing your international tax obligations can add value to your business.

-

Personal Tax Advisory

Our team of personal tax advisors have an unrivalled depth of knowledge and expertise in handling all your compliance requirements in a professional manner. Whether you need assistance with your CAT 2 status application as a High Net Worth Individual, or more general day-to-day tax preparation services and advice, we are here to help.

-

Private Client

Grant Thornton’s experienced team of specialists can help to steer you successfully through a range of tax-related challenges. Whether you are establishing a business in Gibraltar, moving to or from the jurisdiction, transferring wealth, or need help with residence and domicile issues, we offer advice that can help you minimise the burden that taxes may have upon your personal wealth.

Today, insurance plays a critical role in all aspects of business. It enables firms of all sizes to both thrive in growth markets and to weather out less favourable conditions. Getting the balance right can be challenging, whether from increased regulatory requirements or underwriting cycles, developments such as new technologies, increased competition and novel product offerings can compound the complexity.

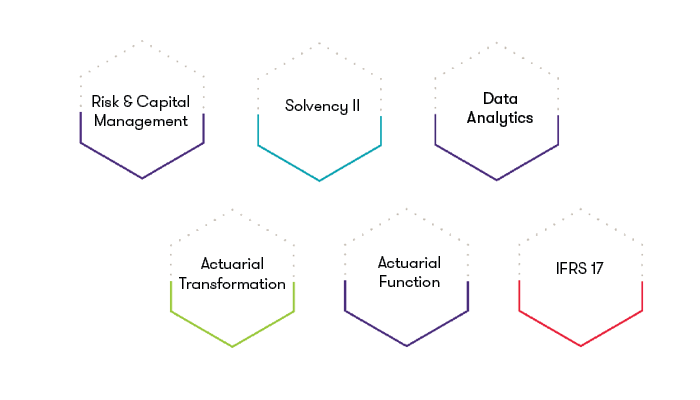

As the volume and variety of developments in the insurance industry continues to grow apace, insurance providers are experiencing issues in securing specialist actuarial expertise within the sector. New compliance requirements around developments such as IFRS 17 and EIOPA’s review of Solvency II, the climate change and sustainability agenda, along with AI and machine learning applications in the insurance industry suggest that constant change is the new normal to which companies must adapt, and the need for specialised knowledge and experience is on the rise.

Our Services

Why Grant Thornton?

Grant Thornton Gibraltar offers a broad range of actuarial services spanning life insurance, non-life insurance, and health insurance. Offering actuarial expertise and integrated services across the evolving data analytics and modelling universe, Grant Thornton’s team of experts and strong international network can provide a range of solutions tailored to your actuarial requirements.